SSS Monthly Contributions – Philippines

Are you an employer or employee?

Self-employed or OFW?

Employer, are you remitting the correct amount of contributions for the benefit of your employees?

Employees, do you know if the amount deducted by your employer from your salary is correct?

Self-employed and OFW, are you making your contributions to SSS?

Social Security System (SSS) was created through Republic Act No. 1161 known as “Social Security Law” to provide sickness, unemployment, retirement, disability and death benefits for employees.

Generally, all employees not over sixty (60) years of age and their employers shall be compulsory in the SSS. An individual is considered employee if “employee-employer relationship” is present.

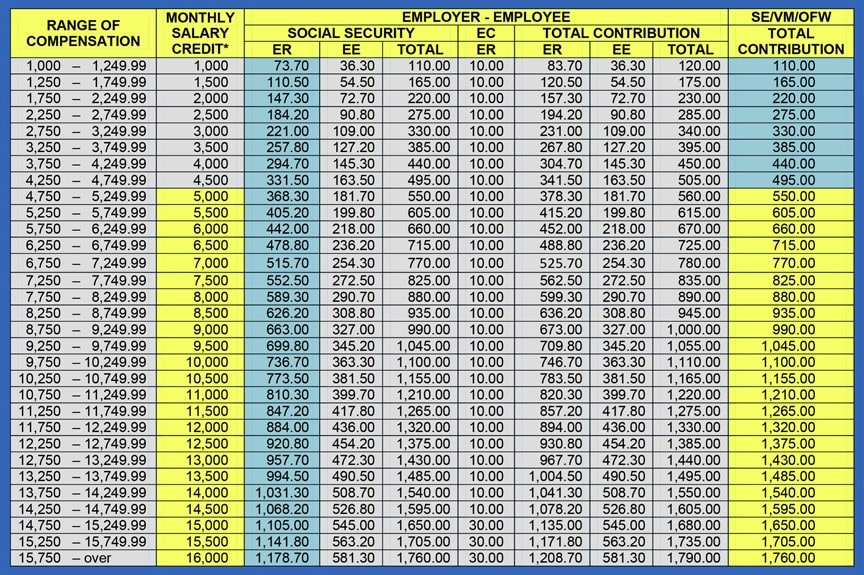

Below is the latest SSS Schedule of Contributions:

SSS Monthly Contribution Computation Table

How to compute for SSS monthly contribution?

First, identify employee’s monthly compensation. Then refer to SSS schedule of contributions to get the amount of employee’s contribution (EE) and employer’s contribution (ER) based on the range of compensation.

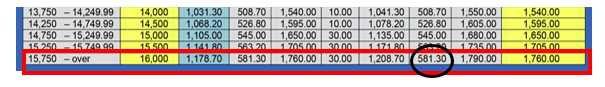

Illustration 1:

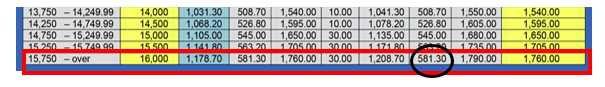

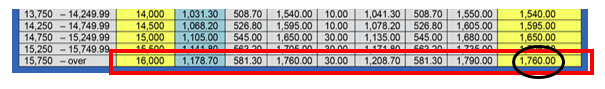

Mr. Delgado is an employee of Scented Manufacturing Inc. His monthly compensation is P18,000.00

- What amount will be deducted from Mr. Santos salary?

Answer: P581.30, this is the employee’s contribution (EE)

SSS Monthly Contributions – Philippines

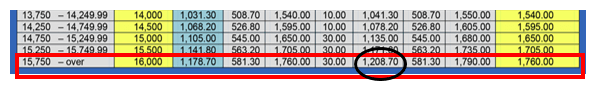

2. How much is the company’s share?

Answer: P1,208.70, this is the employer’s contribution (ER)

SSS Monthly Contribution Computation

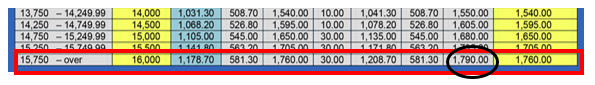

3. What is the total SSS contribution to be remitted by the employer?

Answer: P1,790.00, to remitted using SSS Form R-5 and SSS Form R-3

SSS for remittance = EE + ER

= P581.30 + P1,208.70

= P1,790.00

SSS Monthly Contributions – Philippines

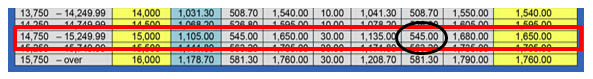

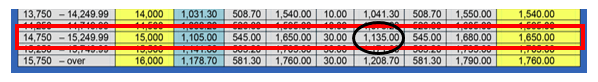

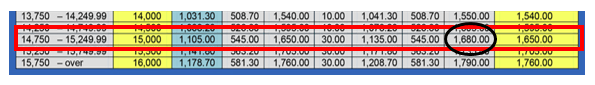

Illustration 2:

Ms. Magsalang is an employee of Paragon Group. Her basic monthly compensation is P14,300.00. During the month, Ms. Magsalang earned overtime pay amounting P1,200.00 and incurred absences & late deduction amounting P400.00

1. What amount will be deducted from Ms. Magsalang salary?

Answer: P545.00, this is the employee’s contribution (EE)

SSS Monthly Contribution Computation

2. How much is the company’s share?

Answer: P1,135.00, this is the employer’s contribution (ER)

SSS Monthly Contribution Computation

3. What is the total SSS contribution to be remitted by the employer?

Answer: P1,680.00, to remitted using SSS Form R-5 and SSS Form R-3

SSS for remittance = EE + ER

= P545.00 + P1,135.00

= P1,680.00

SSS Monthly Contribution Computation

NOTE: Most of the employers uses “basic compensation” as their basis. But in identifying which range employee salary belongs, the correct basis is the “total actual remuneration” as mandated by SSS charter.

In this case, Ms. Magsalang total actual remuneration is P15,100.00.

What is the proper treatment of SSS contribution in company’s accounting records?

- Employee’s contribution (EE) is deduction from employee’s salary, therefore a reduction (debit) to salaries payable

- Employer’s contribution (ER) is an outright expense classified under employee benefits account.

- SSS contribution to be remitted by the employer is a payable account (current liability). It will be debited once remittance is made.

How Self-employed and Voluntary Members do their contribution?

Self-employed (SE) and voluntary members (VM) may opt to monthly or quarterly contribution. Unlike employees who have employers’ share on contribution, SE and VM must pay the full amount of contribution based on their declaration of income/earnings – “monthly salary credit”.

Use SS Form RS-5 upon remittance.

Example:

Mr. Garvando, a freelance accountant has monthly declaration of income amounting to P80,000. His monthly SSS contribution is P1,760.00.

SSS Monthly Contribution Computation Equation

How OFW do their contribution?

Though the same schedule of contribution is being used, OFW’s minimum monthly contribution must be P550.00 or equivalent to minimum monthly salary of P5,000.00. Always refer to the 2nd and 10th column of the table.

Payment of contributions for the months of January to December of a given year may be paid within the same year; contributions for the months of October to December of a given year may also be paid on or before the 31st of January of the succeeding year.

Use SS Form RS-5 upon remittance.

Example:

Mr. Valdez, is an OFW with a monthly declaration of income (monthly salary credit) amounting to P15,000. His monthly SSS contribution is P1,650.00

SSS Monthly Contribution Computation Total

Disclaimer: All content provided in this article is for informational and general discussion purposes only and may become outdated due to constant changes of the laws, rules and regulations over time. It does not substitute for an expert or legal advice. Contact your preferred professional for more detailed and accurate guidance based on your circumstances. For comments, suggestions and inquiries, please contact us at info@kgconsult-ph.com