PHILHEALTH Monthly Contributions – Philippines

Philippine Health Insurance Corporation (PHILHEALTH) is created through Republic Act No. 7875 known as “National Health Insurance Act of 1995”, for the purpose of instituting a national health insurance program for all Filipinos.

Section II, Article XIII of the 1987 Constitution of the Republic of the Philippines declares that the State shall adopt an integrated and comprehensive approach to health development which shall endeavor to make essential goods, health and other social services available to all the people at affordable cost. Priority of the needs of the underprivileged, sick, elderly, disabled, women, and children shall be recognized. Likewise, it shall be the policy of the State to provide free medical care to paupers.

Section IV, National Insurance Act of 2013, All Filipinos shall be mandatorily covered under the Program. In accordance with the principles of universality and compulsory coverage enunciated in Section 2(b) and 2(l) of the Act, implementation of the Program shall ensure sustainability of coverage and continuous enhancement of the quality of service. The Program shall be compulsory in all provinces, cities and municipalities nationwide, notwithstanding the existence of LGU-based health insurance programs. The Corporation, DOH, LGUs, and other agencies including Non-Governmental Organizations (NGOs) and other National Government Agencies (NGAs) shall ensure that members in such localities shall have access to quality and cost-effective health care services.

To enjoy and avail such services, employer and employees must have their respective contributions to the PhilHealth.

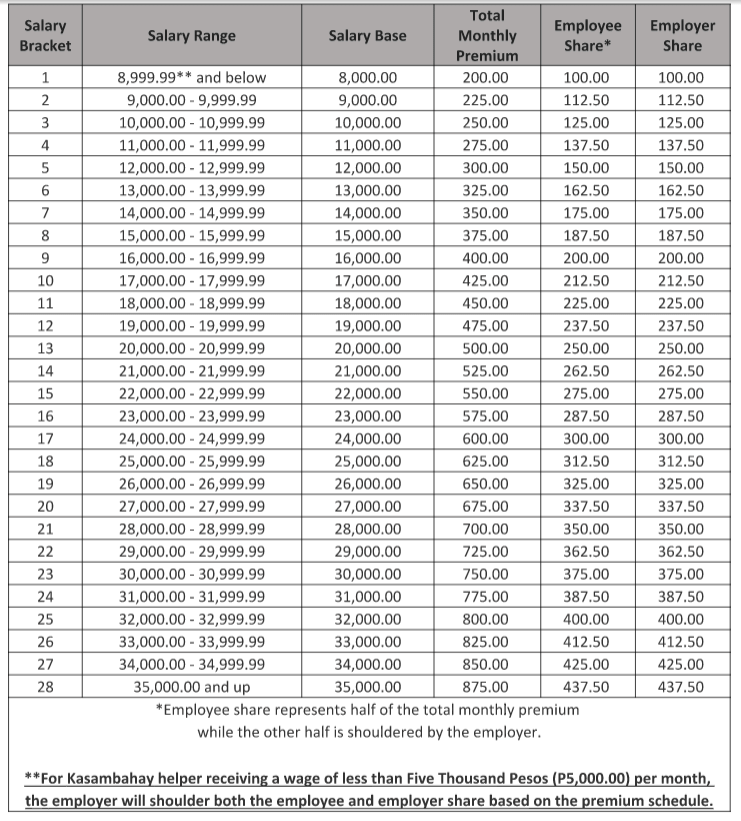

Below is the latest Premium Contribution Table (employees and employers):

How to compute for PHILHEALTH monthly contribution?

Simply refer to the premium contribution table and check where your salary bracket belongs. Actually, employee and employer have the same amount of share.

Illustration 1:

Ms. Reyes, an employee of Sunflower General Merchandise has a monthly salary of P29,000.00

- What amount will be deducted from Mr. Santos salary?

Answer: P362.50,

- How much is the company’s share?

Answer: P362.50

What is the total monthly PHILHEALTH premium to be remitted by the employer?

What is the total monthly PHILHEALTH premium to be remitted by the employer?

Answer: P725.00, remit using PhilHealth Form RF-1

Premium for remittance = Employee share + Employer share

= P362.50 + P362.50

= P725.00

Illustration 2:

Illustration 2:

Anastasio works as a gardener to Don Antonio’s family. His monthly salary is P3,000.00.

- What amount will be deducted from Anastasio’s salary?

Answer: NONE - Under Republic Act No. 10361 also known as “Domestic Workers Act” or “Batas Kasambahay”, Anastasio is considered as kasambahay, therefore all premium payments shall be shouldered by his employer. But if he is receiving P5,000.00 and above per month, the proportionate share in premium shall be deducted from his salary in accordance with the law.

- How much is the total premium shouldered by the employer?

Answer: P200.00, the minimum monthly premium

What is the proper treatment of PHILHEALTH premium in company’s accounting records?

- Employee’s share is deduction from employee’s salary, therefore a reduction (debit) to salaries payable

- Employer’s share is an outright expense classified under employee benefits account.

- PHILHEALTH premium to be remitted by the employer is a payable account (current liability). It will be debited once remittance is made.

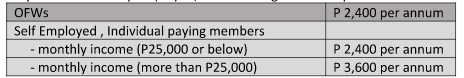

How much is the contribution of Self-Employed, OFWs and individual paying members?

If you are not locally employed, the following are the required contributions

For more information, visit http://www.philhealth.gov.ph. You may also contact PhilHealth Call Center at +632 441-7442.

For more information, visit http://www.philhealth.gov.ph. You may also contact PhilHealth Call Center at +632 441-7442.

Disclaimer: All content provided in this article is for informational and general discussion purposes only and may become outdated due to constant changes of the laws, rules and regulations over time. It does not substitute for an expert or legal advice. Contact your preferred professional for more detailed and accurate guidance based on your circumstances. For comments, suggestions and inquiries, please contact us at info@kgconsult-ph.com