Vacation Leave and Sick Leave are two common leave benefits being provided by the companies in the Philippines. Number of days vary depending on company policy. Some are even forwarding the unused portion to the following year and there are also who converts it to cash every December.But how vacation leave and sick leave are related to Service Incentive Leave (SIL)? Are they the same? Does service incentive leave convertible to cash?

Service Incentive Leave (SIL)

Service Incentive Leave of five (5) days with pay is given to every employee who has rendered at least one (1) year of service in the company. This is a mandatory benefit as lay down in Article 95 of the Labor Code with the title “Right to service incentive leave”.

“One year of service” of the employee means service within twelve (12) months, whether continuous or broken, reckoned from the date the employee started working. The period includes authorized absences, unworked weekly rest days, and paid regular holidays. If through individual or collective agreement, company practice or policy, the period of the working days is less than twelve (12) months, said period shall be considered as one year for the purpose of determining the entitlement to the service incentive leave.

However, Service Incentive Leave (SIL) is no longer applicable to those who are already enjoying the benefit herein provided, those enjoying vacation leave with pay of at least five days and those employed in establishments regularly employing less than ten employees or in establishments exempted from granting this benefit by the Secretary of Labor and Employment after considering the viability or financial condition of such establishment.

- Government employees, whether employed by the National Government or any of its political subdivisions, including those employed in government owned and/or controlled corporations with original charters or created under special laws;

- Persons in the personal service of another;

- Managerial employees, if they meet all of the following conditions:

- Their primary duty is to manage the establishment in which they are employed or of a department or subdivision thereof;

- They customarily and regularly direct the work of two or more employees therein;

- They have the authority to hire or fire other employees of lower rank; or their suggestions and recommendations as to hiring, firing, and promotion, or any other change of status of other employees are given particular weight.

- Officers or members of a managerial staff, if they perform the following duties and responsibilities:

- Primarily perform work directly related to management policies of their employer;

- Customarily and regularly exercise discretion and independent judgment;

- (I) Regularly and directly assist a proprietor or managerial employee in the management of the establishment or subdivision thereof in which he or she is employed; or (II) execute, under general supervision, work along specialized or technical lines requiring special training, experience, or knowledge; or (III) execute, under general supervision, special assignments and tasks; and

- Do not devote more than twenty percent (20%) of their hours worked in a workweek to activities which are not directly and closely related to the performance of the work described in paragraphs paragraphs 4.a, 4.b, and 4.c, above;

- Field personnel and those whose time and performance is unsupervised by the employer;

- Those already enjoying this benefit;

- Those enjoying vacation leave with pay of at least five (5) days; and

- Those employed in establishments regularly employing less than ten (10) employees.

Does employer can give Service Incentive Leave to employee who do not complete yet the 1 year of service in the company?

YES. Leave credit is a management discretion and it is allowed as long as it is not contrary to the law. Providing leave in advance (whether it is called a service incentive leave, sick leave or vacation leave) is highly beneficial to the employees and there is no law that prohibits that. (Article 95.c stated that “The grant of benefit in excess of that provided herein shall not be made a subject of arbitration or any court or administrative action.”)

Is Service Incentive Leave convertible to cash?

The service incentive leave may be used for sick and vacation leave purposes. The unused service incentive leave is commutable to its money equivalent at the end of the year. In computing, the basis shall be the salary rate at the date of conversion. The use and conversion of this benefit may be on a pro rata basis.

Computation of Service Incentive Leave Credit and Cash Conversion

Illustration 1

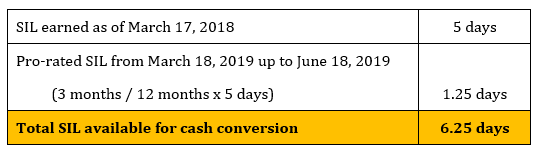

An employee was hired on March 18, 2018 and resigned on June 18, 2019. Assuming that he/she has not used or commuted any of his/her accrued SIL, he/she is entitled to the conversion of his/her accrued SIL, upon his/her resignation, as follows:

Illustration 2

Jennifer Manlangit is working 8 hours a day every Monday to Friday. Her monthly salary is P25,000. She is entitled to 15-day vacation leave and 15-day sick leave for a total of 30 days leave credits per year.

Scenario 1: She used a total of 20 days paid leaves. Does she entitle to cash conversion for the remaining 10 unused leave days?

Answer: NO. Leave conversion is applicable only for maximum of 5 days leave with pay per year. If the employee is receiving more than that and already utilized at least 5 days, no more cash conversion is allowed unless there is favorable company policy.

Scenario 2: Out of 30 days, she only used 3 days of her leave credits. Does she entitle to cash conversion?

Answer: YES, but for 2 days only unless there is favorable company policy.

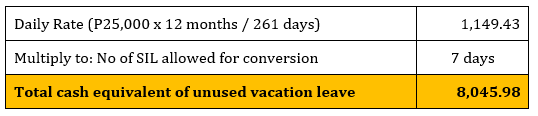

Scenario 3: The company will be converting all unused vacation leave into to cash. Assuming, Jennifer unused vacation leave is 7 days, how much is the cash equivalent she should receive?

Answer: P8,045.98

Formula for cash conversion of leave credits: Daily Rate multiply by No. of Days

References: Article 95 of the Labor Code, Handbook on Workers Statutory Monetary Benefits 2019 Edition

Disclaimer: All content provided in this article is for informational and general discussion purposes only and may become outdated due to constant changes of the laws, rules and regulations over time. It does not substitute for an expert or legal advice. Contact your preferred professional for more detailed and accurate guidance based on your circumstances. For comments, suggestions and inquiries, please contact us at info@kgconsult-ph.com

1 Comment. Leave new

Question:

1. During this time of pandemic, are those employees on forced leave status for 6 months entitled of leave credits? Our company give 15 days vacation leave and 15 days Sick leave

How do we compute leave credits if an employees worked like once a week or 4 days a month.