The Basic Accounting Equation

Understanding accounting means understanding its equation as the basic principle of accounting and fundamental elements of Balance Sheet or Statement of Financial Position

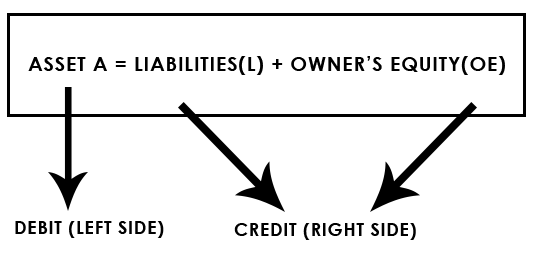

Accounting equation mirrors the principle of equality of debit and credit. It is considered the basis of double-entry bookkeeping system. It conform to the concept that in every value received, there is corresponding value given up.

- You received something because you paid for it or you are oblige to pay in the future.

- You are collecting payments because of the services you rendered or products you sold.

And I say in layman’s term, you will receive the same value you gave.

BASIC ACCOUNTING EQUATION

ASSET – resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity

Example of Asset: Cash, Accounts Receivable, Prepaid Expenses, Inventories, Property Plant & Equipment

LIABILITIES – present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits

Example of Liability: Accounts Payable, Salaries Payable, Loans Payable, Income Tax Payable

OWNER’S EQUITY (SHAREHOLDER’ S EQUITY OR CAPITAL) – is the residual interest in the asset of the entity after deducting all liabilities. Also known as net worth and net asset

Owner’s Equity composed of: Owner’s investment net of drawing, Share Capital, Share Premium, Retained Earnings

Illustration 1

Melendez Trading account balances at the end of December 31, 2014 are as follows:

Cash 300,000.00; Loan’s Payable 150,000.00; Prepaid Rent 30,000; Accounts Payable 70,000; Inventories 50,000; Salaries Payable 100,000; Owner’s Investment 50,000; Owner’s Drawing 20,000; Net Income 30,000

Answer: 380,000

Computation: Cash + Prepaid Expense + Inventories

300,000 + 30,000 + 80,000

= 380,000Question 2: How much is the Total Liabilities?

Answer: 320,000

Computation: Loans Payable + Accounts Payable + Salaries Payable

150,000 + 70,000 + 100,000

= 320,000Question 2: How much is the Total Owner’s Equity?

Answer: 60,000

Computation: Owner’s Investment – Owner’s Drawing + Net Income

50,000 – 20,000 + 30,000

= 60,000Therefore, applying the basic accounting equation:

Asset = Liabilities + Owner’s Equity

380,000 = 320,000 + 60,000

Let say, Owner’s Equity amount is not given, will you able to compute for it? Absolutely YES!

Liabilities = Asset – Owner’s Equity (L = A – OE)

Owner’s Equity = Asset – Liabilities (OE = A – L)

Applying one of the above formulas, Owner’s Equity is 60,000

Computation: OE = A – L

= 380,000 – 320,000

= 60,000

Illustration 2

Melendez Trading account balances at the end of December 31, 2014 are as follows:

Cash 230,000.00; Loan’s Payable 50,000.00; Prepaid Expenses 90,000; Accounts Payable 150,000; Inventories 80,000; Salaries Payable 100,000; Owner’s Investment 300,000; Owner’s Drawing 70,000; Sales 600,000; Cost and Expenses 630,000; Property Plant & Equipment ?

Answer: 300,000

Computation:

Main Formula: Asset = Liabilities + OEFind: Liabilities

Accounts Payable + Loans Payable + Salaries Payable

50,000 + 150,000 + 100,000

= 300,000Find: Owner’s Equity

Owner’s Investment – Owner’s Drawing – Net Loss (Sales – Cost and Expenses)

300,000 – 70,000 – 30,000 (600,000 – 630,000)

= 200,000Asset = Liabilities + Owner’s Equity

= 300,000 + 200,000

= 500,000Question 2: What is the amount of company’s Property Plant and Equipment?

Answer: 100,000

Computation:

Asset = Cash + Prepaid Expense + Inventories + Property, Plant and Equipment

500,000 = 230,000 + 90,000 + 80,000 + X

500,000 = 400,000 + X

500,000 = 400,000 + 100,000

Illustration 3

Vincent Shine Corp. bought vehicle amounting to P1,500,000 in cash. What is the effect of this transaction to company’s asset?

Answer: None

The company acquired an Asset (Vehicle) but same amount was released as payment through Cash which is an Asset account also, therefore no effect on Asset account. This is a simple example of “for every value received, there is a value parted with”.

“A = L + OE” is the mother formula of all accounting formulas. Remember, DEBIT (left side) MUST always equal to CREDIT (right side). This will serve as a basic guide in your further study of accounting.

Disclaimer: All content provided in this article is for informational and general discussion purposes only and may become outdated due to constant changes of the laws, rules and regulations over time. It does not substitute for an expert or legal advice. Contact your preferred professional for more detailed and accurate guidance based on your circumstances. For comments, suggestions and inquiries, please contact us at info@kgconsult-ph.com